Navigating The 401(k) Landscape: A Guide To Contribution Limits In 2025

Navigating the 401(k) Landscape: A Guide to Contribution Limits in 2025

Navigating the 401(k) Landscape: A Guide to Contribution Limits in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 401(k) Landscape: A Guide to Contribution Limits in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 401(k) Landscape: A Guide to Contribution Limits in 2025

The 401(k) plan stands as a cornerstone of retirement planning for many Americans. These employer-sponsored retirement savings plans allow individuals to contribute pre-tax income, growing tax-deferred until retirement. Understanding the contribution limits associated with these plans is crucial for maximizing retirement savings potential. This article delves into the projected 401(k) contribution limits for 2025, offering insights into how these limits impact individual retirement planning.

Understanding the Mechanics of 401(k) Contribution Limits

The Internal Revenue Service (IRS) sets annual contribution limits for 401(k) plans. These limits represent the maximum amount individuals can contribute to their 401(k) accounts each year, regardless of income level. The IRS typically adjusts these limits annually to account for inflation and other economic factors.

Projected 401(k) Contribution Limits for 2025

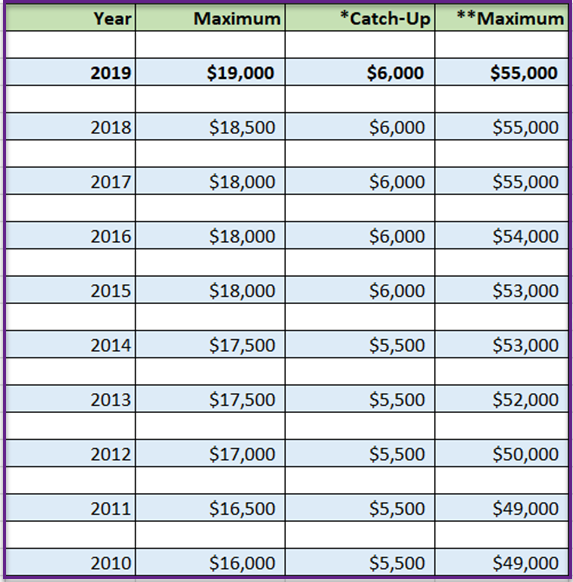

While official figures for 2025 will not be released until later in 2024, projections based on historical trends and economic indicators suggest the following potential limits:

- Employee Contribution Limit: The projected employee contribution limit for 2025 is $22,500. This represents an increase from the 2024 limit of $22,500. This limit applies to individuals under the age of 50.

- Catch-Up Contribution Limit: For individuals aged 50 and above, the projected catch-up contribution limit for 2025 is $7,500. This allows older individuals to contribute an additional amount beyond the regular employee limit to accelerate their retirement savings.

The Importance of 401(k) Contribution Limits

The 401(k) contribution limits play a critical role in retirement planning by:

- Encouraging Regular Savings: The defined limits serve as a guideline for individuals to establish a consistent savings habit. This encourages a disciplined approach to retirement planning, fostering a sense of financial responsibility.

- Maximizing Tax Advantages: Contributing to a 401(k) plan allows individuals to defer paying taxes on their contributions and earnings until retirement. This can lead to significant tax savings over the long term.

- Building a Robust Retirement Nest Egg: By maximizing contributions within the limits, individuals can accumulate a substantial retirement nest egg, providing financial security during their post-retirement years.

Factors Influencing 401(k) Contribution Limits

The IRS carefully considers several factors when determining annual contribution limits:

- Inflation: The cost of living steadily increases over time, and the IRS adjusts contribution limits to reflect this inflation. This ensures that the purchasing power of retirement savings remains relatively consistent.

- Economic Growth: The overall economic performance also influences contribution limits. When the economy is strong and wages are rising, the IRS may adjust limits upwards to reflect increased earning potential.

- Retirement Security: The IRS aims to ensure that individuals have sufficient resources to maintain a comfortable standard of living in retirement. By adjusting contribution limits, they encourage individuals to save adequately for their future.

FAQs Regarding 401(k) Contribution Limits

1. What happens if I exceed the contribution limit?

If you exceed the 401(k) contribution limit, you may be subject to penalties. These penalties can include a 10% tax on the excess contribution and additional interest charges. It is essential to carefully track your contributions to avoid exceeding the limit.

2. Can I change my contribution amount throughout the year?

Yes, you can typically adjust your contribution amount throughout the year. However, it’s best to consult with your employer or plan administrator to understand the specific procedures for making adjustments.

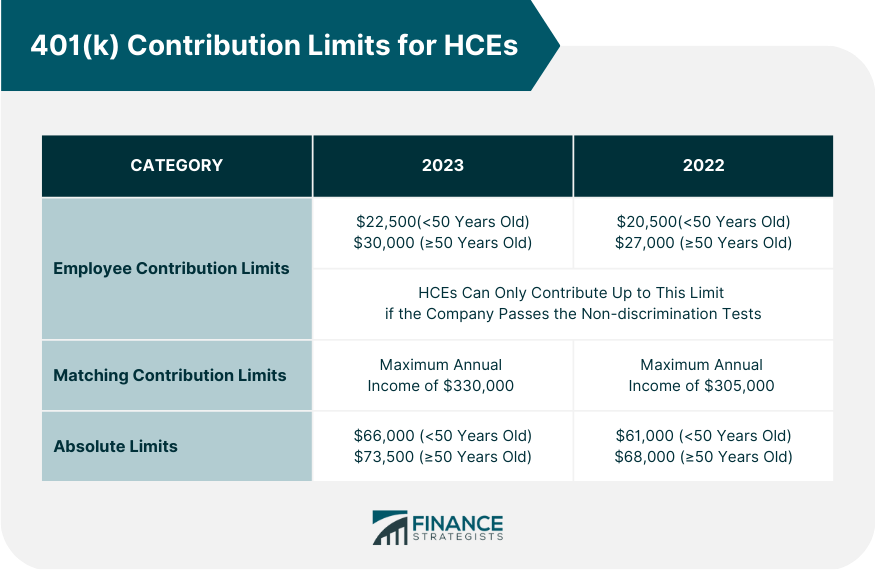

3. What if my employer offers a matching contribution?

Employer matching contributions are a valuable benefit that can significantly boost your retirement savings. Make sure to contribute enough to receive the full matching amount. This is essentially "free money" that can accelerate your retirement savings growth.

4. How do I know if I’m contributing enough?

There is no one-size-fits-all answer to this question. However, a general guideline is to aim to contribute at least 15% of your pre-tax income to your 401(k) plan. This can vary depending on your age, risk tolerance, and financial goals.

5. What happens to my 401(k) when I leave my job?

When you leave your job, you have several options for your 401(k) account. You can leave it with your former employer, roll it over to an IRA, or cash it out. The best option for you will depend on your individual circumstances and financial goals.

Tips for Maximizing 401(k) Contributions

- Start Early: The earlier you begin contributing to your 401(k), the more time your savings have to grow. Even small contributions can accumulate significantly over the long term.

- Increase Contributions Gradually: Consider increasing your contribution percentage gradually over time. This can help you adjust to higher contributions and avoid feeling overwhelmed.

- Take Advantage of Employer Matching: If your employer offers a matching contribution, make sure to contribute enough to receive the full match.

- Review Your Contribution Allocation: Regularly review your investment allocation to ensure it aligns with your risk tolerance and retirement goals.

- Consider a Roth 401(k): If available, consider a Roth 401(k) option. This allows you to contribute after-tax dollars, but your withdrawals in retirement will be tax-free.

Conclusion

The 401(k) contribution limits for 2025 are expected to reflect the ongoing efforts to encourage individuals to prioritize retirement savings. By understanding the mechanics of these limits, individuals can make informed decisions about their retirement planning, maximizing the benefits of tax-deferred savings and building a solid foundation for a financially secure future. Remember, it’s never too early or too late to start saving for retirement. Regular contributions to a 401(k) plan can make a significant difference in achieving your long-term financial goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 401(k) Landscape: A Guide to Contribution Limits in 2025. We appreciate your attention to our article. See you in our next article!