Navigating The 2025 IRS 401(k) Contribution Limits: A Guide For Savvy Savers

Navigating the 2025 IRS 401(k) Contribution Limits: A Guide for Savvy Savers

Navigating the 2025 IRS 401(k) Contribution Limits: A Guide for Savvy Savers

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2025 IRS 401(k) Contribution Limits: A Guide for Savvy Savers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 IRS 401(k) Contribution Limits: A Guide for Savvy Savers

The 2025 IRS 401(k) contribution limits represent a significant opportunity for individuals to bolster their retirement savings. While the exact figures for 2025 are not yet finalized, understanding the mechanics of these limits and their potential impact is crucial for maximizing retirement preparedness.

Understanding the Basics

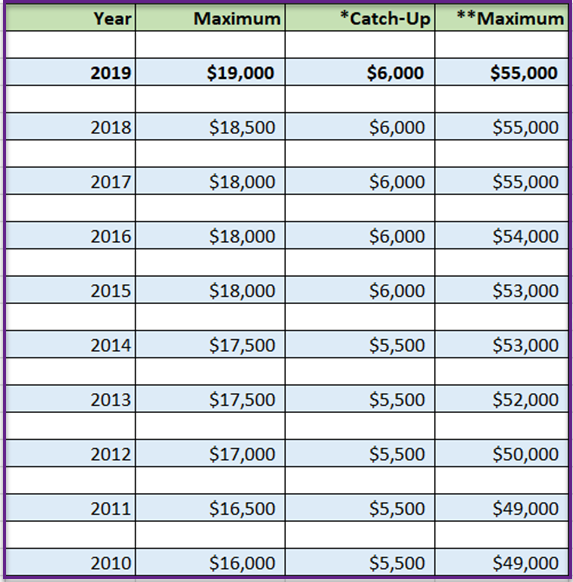

The IRS sets annual contribution limits for 401(k) plans, which are employer-sponsored retirement savings plans. These limits dictate the maximum amount of money an individual can contribute to their 401(k) each year. The contribution limits are adjusted annually to account for inflation and other economic factors.

The Catch-Up Contribution: A Boon for Older Workers

For individuals aged 50 and over, the IRS allows for an additional "catch-up" contribution. This allows older workers to contribute an extra amount beyond the standard limit, effectively accelerating their retirement savings. This provision acknowledges the need for greater savings accumulation as retirement approaches.

The 2025 Outlook: Projections and Potential Changes

While the specific 2025 401(k) contribution limits are subject to change, projections based on historical trends suggest a potential increase. The IRS typically announces these limits in the latter half of the previous year.

The Importance of Staying Informed

Staying abreast of these annual adjustments is crucial for individuals seeking to maximize their retirement savings. Understanding the current and projected limits allows for informed financial planning and strategic adjustments to savings strategies.

Benefits of Maximizing Contributions

- Accelerated Savings Growth: Higher contributions lead to greater compound interest, potentially generating significant wealth over time.

- Tax Advantages: 401(k) contributions are pre-tax, meaning that taxes are not paid until retirement, effectively lowering current taxable income.

- Retirement Security: Maximizing contributions enhances financial security during retirement, providing greater financial flexibility and peace of mind.

FAQs about 2025 401(k) Contribution Limits

Q: When will the 2025 IRS 401(k) contribution limits be finalized?

A: The IRS typically announces the annual contribution limits in the latter half of the preceding year. Therefore, the 2025 limits are expected to be announced in late 2024.

Q: How do I know if I qualify for the catch-up contribution?

A: You qualify for the catch-up contribution if you are aged 50 or older during the calendar year.

Q: What are the potential consequences of exceeding the contribution limit?

A: Exceeding the contribution limit can result in penalties and taxes. It is essential to stay within the designated limits.

Q: Can I change my contribution amount during the year?

A: Yes, you can adjust your contribution amount throughout the year. However, it is generally recommended to set a consistent contribution strategy to ensure maximum savings.

Tips for Maximizing 2025 401(k) Contributions

- Review your current contribution rate: Ensure that you are maximizing your contributions within the current limits.

- Consider increasing your contribution rate: Explore the possibility of increasing your contribution rate to take advantage of the 2025 limits.

- Utilize the catch-up contribution: If eligible, take advantage of the catch-up contribution to accelerate your savings.

- Stay informed about the latest limits: Monitor the IRS website and financial news sources for updates on the 2025 limits.

- Consult a financial advisor: Seek professional guidance to create a personalized retirement savings plan.

Conclusion

The 2025 IRS 401(k) contribution limits present a valuable opportunity for individuals to bolster their retirement savings. By understanding the mechanics of these limits, staying informed about changes, and strategically adjusting contribution strategies, individuals can maximize their retirement preparedness. Proactive engagement with these limits can contribute significantly to achieving a secure and comfortable retirement.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 IRS 401(k) Contribution Limits: A Guide for Savvy Savers. We appreciate your attention to our article. See you in our next article!