Navigating The 2025 IRS 401(k) Catch-Up Contribution Landscape: A Comprehensive Guide

Navigating the 2025 IRS 401(k) Catch-Up Contribution Landscape: A Comprehensive Guide

Navigating the 2025 IRS 401(k) Catch-Up Contribution Landscape: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2025 IRS 401(k) Catch-Up Contribution Landscape: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 IRS 401(k) Catch-Up Contribution Landscape: A Comprehensive Guide

The 401(k) plan offers a powerful tool for individuals to build a secure financial future. For those approaching retirement, the IRS provides a valuable provision: catch-up contributions. These allow individuals aged 50 and older to contribute an additional amount to their 401(k) plans, bolstering their retirement savings. Understanding the nuances of these catch-up contributions, particularly as they evolve over time, is crucial for maximizing retirement preparedness.

2025: A Look Ahead

While specific figures for 2025 are subject to change based on inflation and other economic factors, it’s essential to understand the general framework governing these contributions. The IRS typically adjusts contribution limits annually to account for inflation.

The Basics of Catch-Up Contributions

Catch-up contributions are designed to help older individuals compensate for potentially lost time in saving for retirement. The rationale is simple: those approaching retirement have fewer years to accumulate wealth, necessitating higher contributions to reach their financial goals.

Key Points to Remember

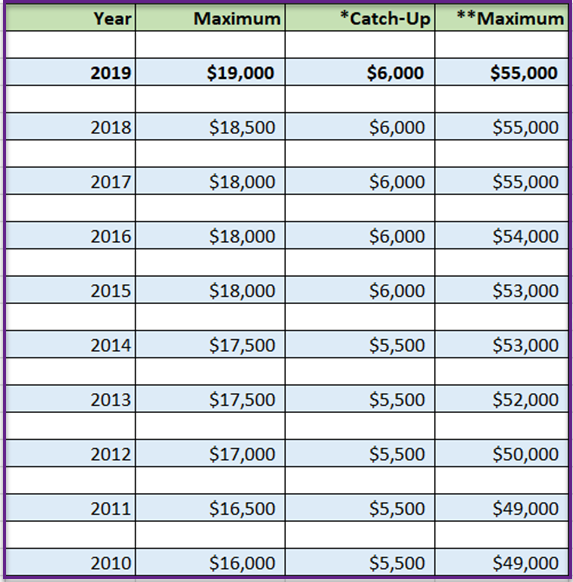

- Eligibility: Individuals aged 50 and older can contribute an additional amount to their 401(k) plans beyond the standard annual contribution limit.

- Contribution Limits: The catch-up contribution limit is separate from the regular annual contribution limit. This means individuals can contribute the maximum amount allowed for their age group, plus the additional catch-up amount.

- Tax Advantages: Contributions to 401(k) plans, including catch-up contributions, are made on a pre-tax basis, meaning they reduce taxable income in the current year. The taxes on these contributions are deferred until retirement.

- Investment Options: Catch-up contributions are subject to the same investment options available within the individual’s 401(k) plan.

Understanding the Importance of Catch-Up Contributions

The ability to contribute extra to a 401(k) plan in the years leading up to retirement offers significant benefits:

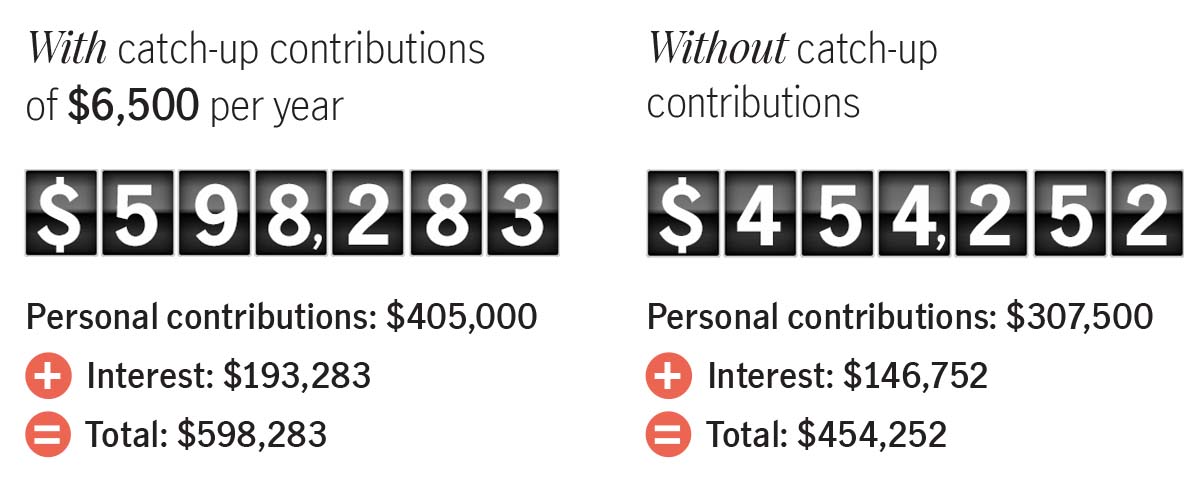

- Accelerated Savings: Catch-up contributions can significantly accelerate the growth of retirement savings. The power of compound interest works in favor of those who contribute more, especially over a longer period.

- Retirement Security: By contributing more, individuals can increase the likelihood of achieving their desired retirement lifestyle.

- Financial Flexibility: Higher retirement savings provide greater financial flexibility in retirement, allowing individuals to pursue their passions, travel, or handle unexpected expenses.

Navigating the 2025 Landscape

While the exact figures for 2025 are not yet finalized, individuals can prepare by understanding the general trends and potential changes.

- Inflation Adjustment: The IRS typically adjusts contribution limits annually to account for inflation. This means the catch-up contribution limit in 2025 is likely to be higher than in 2024.

- Policy Changes: The IRS may implement policy changes affecting 401(k) plans and catch-up contributions. Individuals should stay informed about any updates or changes.

Frequently Asked Questions

Q: When can I start making catch-up contributions?

A: You can start making catch-up contributions to your 401(k) plan in the year you turn 50.

Q: What is the catch-up contribution limit for 2025?

A: The specific catch-up contribution limit for 2025 is not yet finalized. However, it is likely to be adjusted for inflation, potentially exceeding the 2024 limit.

Q: Can I contribute the maximum amount to my 401(k) and also make catch-up contributions?

A: Yes, you can contribute the maximum amount allowed for your age group, plus the additional catch-up contribution.

Q: What happens if I contribute more than the allowed limit?

A: If you contribute more than the allowed limit, you may be subject to penalties and taxes.

Q: Are catch-up contributions subject to the same tax benefits as regular 401(k) contributions?

A: Yes, catch-up contributions are also tax-deferred, meaning taxes are not paid until retirement.

Tips for Maximizing Catch-Up Contributions

- Review Your Plan Documents: Familiarize yourself with the specific rules and regulations governing catch-up contributions in your 401(k) plan.

- Consult a Financial Advisor: A qualified financial advisor can help you develop a personalized retirement savings plan and determine if catch-up contributions are right for you.

- Automate Contributions: Set up automatic contributions to your 401(k) plan, including catch-up contributions, to ensure consistent saving.

- Monitor Your Progress: Regularly review your retirement savings progress and adjust your contributions as needed.

Conclusion

The IRS catch-up contribution provision offers a valuable opportunity for individuals approaching retirement to accelerate their savings and enhance their financial security. By understanding the rules, maximizing contributions, and seeking professional advice, individuals can effectively leverage this tool to build a robust retirement nest egg. Remember to stay informed about any changes in contribution limits and regulations to ensure your retirement savings strategy remains on track.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 IRS 401(k) Catch-Up Contribution Landscape: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!