Navigating Retirement Savings In 2025: Understanding 401(k) Contribution Limits For Individuals Over 50

Navigating Retirement Savings in 2025: Understanding 401(k) Contribution Limits for Individuals Over 50

Navigating Retirement Savings in 2025: Understanding 401(k) Contribution Limits for Individuals Over 50

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Retirement Savings in 2025: Understanding 401(k) Contribution Limits for Individuals Over 50. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Retirement Savings in 2025: Understanding 401(k) Contribution Limits for Individuals Over 50

As individuals approach and surpass the age of 50, the importance of retirement planning intensifies. The Internal Revenue Service (IRS) recognizes this need by offering a valuable tool: the catch-up contribution provision for 401(k) plans. This provision allows individuals aged 50 and older to contribute additional funds beyond the standard contribution limit, bolstering their retirement savings potential. Understanding these limits and how they apply in 2025 is crucial for maximizing retirement security.

A Comprehensive Look at 2025 401(k) Contribution Limits

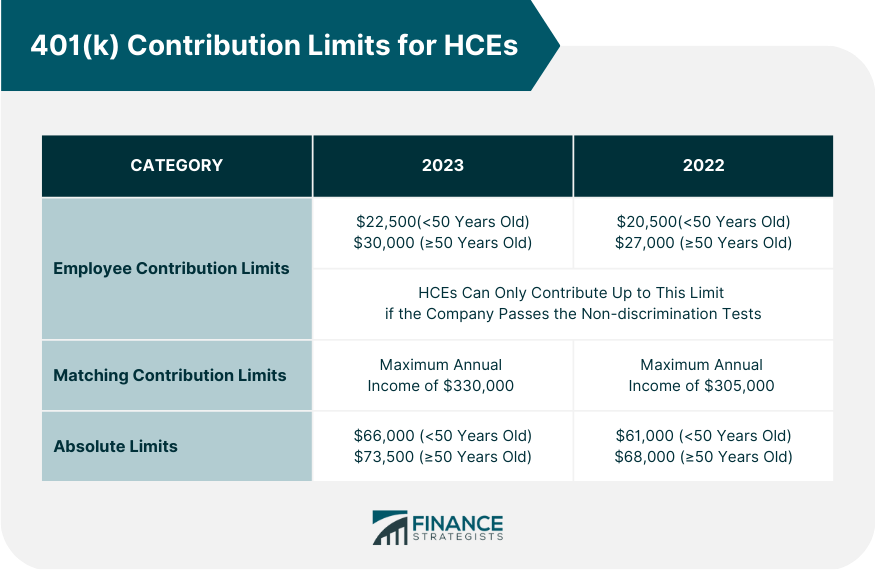

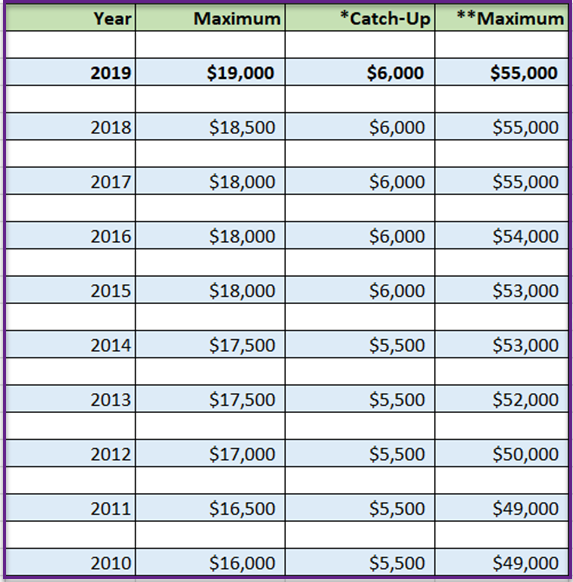

The IRS annually adjusts contribution limits for various retirement plans, including 401(k)s. While these limits are subject to change, current projections suggest the following contribution limits for 2025:

- Standard Contribution Limit: Individuals under 50 can contribute up to $22,500 to their 401(k) plan in 2025.

- Catch-up Contribution Limit: Individuals aged 50 and over are eligible for an additional $7,500 catch-up contribution, bringing their total contribution limit to $30,000.

Understanding the Significance of Catch-Up Contributions

The catch-up contribution provision offers a valuable advantage for individuals in their later working years. It allows them to accelerate their retirement savings, potentially bridging the gap between their desired retirement lifestyle and their accumulated savings. This additional contribution capacity can be particularly beneficial for those who may have started saving later in life or experienced financial setbacks that hindered their savings progress.

Factors Influencing Contribution Limits

It is important to note that the contribution limits outlined above are subject to change based on legislative decisions and inflation adjustments. The IRS typically announces any changes to contribution limits in the fall preceding the applicable tax year. It is crucial to stay informed about these updates to ensure compliance and maximize savings potential.

Exploring the Benefits of Maximizing Contributions

Maximizing 401(k) contributions, including catch-up contributions, offers numerous advantages for retirement planning:

- Tax-Deferred Growth: Contributions to a 401(k) plan are made with pre-tax dollars, allowing individuals to reduce their taxable income and immediate tax liability. Earnings within the account also grow tax-deferred, meaning taxes are not paid until funds are withdrawn in retirement.

- Compounding Returns: The power of compounding works in favor of 401(k) contributions. With each year, earnings on the initial investment contribute to further growth, accelerating the accumulation of savings.

- Potential for Employer Matching: Many employers offer matching contributions to their employees’ 401(k) plans. This matching contribution serves as a valuable incentive to participate in the plan and further boosts retirement savings.

- Protection from Market Volatility: 401(k) investments are typically diversified across a range of asset classes, providing some protection against market fluctuations. This diversification strategy helps to mitigate risk and potentially enhance long-term returns.

Frequently Asked Questions (FAQs) about 2025 401(k) Contribution Limits

Q1: Can I contribute the full catch-up amount if I haven’t contributed to my 401(k) in previous years?

A1: Yes, you can contribute the full catch-up amount even if you have not contributed to your 401(k) in previous years. The catch-up provision applies to any individual aged 50 or older, regardless of their prior contribution history.

Q2: Can I contribute to both a traditional and Roth 401(k) and still utilize the catch-up contribution?

A2: The catch-up contribution can be applied to either a traditional or Roth 401(k) account. However, you cannot exceed the total contribution limit, which is $30,000 for 2025.

Q3: How does the catch-up contribution affect my required minimum distributions (RMDs)?

A3: The catch-up contribution does not affect your RMDs. RMDs are calculated based on the total balance of your 401(k) account, including both regular and catch-up contributions.

Q4: What happens if I contribute more than the limit?

A4: If you exceed the contribution limit, you may be subject to penalties. The IRS imposes a 10% penalty on excess contributions, as well as a 6% penalty on any earnings generated by the excess contributions.

Q5: Is there a limit on how much I can contribute to my 401(k) after I retire?

A5: Once you retire, you can continue to contribute to your 401(k) if your employer allows it. However, you will no longer be eligible for the catch-up contribution once you reach age 72.

Tips for Maximizing 401(k) Contributions

- Review Your Contribution Rate: Regularly assess your contribution rate and consider increasing it to take advantage of the catch-up provision.

- Seek Professional Advice: Consult with a financial advisor to develop a comprehensive retirement plan and determine the optimal contribution strategy for your circumstances.

- Understand Your Employer’s Matching Program: Take full advantage of your employer’s matching contribution program to maximize your retirement savings potential.

- Consider Rollovers: If you have funds in other retirement accounts, such as an IRA, consider rolling them over into your 401(k) to potentially benefit from the catch-up contribution.

- Stay Informed: Keep abreast of any changes to contribution limits and other retirement planning regulations.

Conclusion

The 2025 401(k) contribution limits, including the catch-up provision for individuals over 50, offer a valuable opportunity to accelerate retirement savings. By maximizing contributions, individuals can build a more secure financial future, potentially achieving their desired retirement lifestyle. It is essential to understand these limits, explore the benefits they offer, and make informed decisions to optimize retirement savings. Consulting with a financial advisor can provide personalized guidance and ensure that your retirement plan is aligned with your financial goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating Retirement Savings in 2025: Understanding 401(k) Contribution Limits for Individuals Over 50. We thank you for taking the time to read this article. See you in our next article!