Navigating Retirement Savings: A Guide To 401(k) Contribution Limits For Individuals Over 50 In 2025

Navigating Retirement Savings: A Guide to 401(k) Contribution Limits for Individuals Over 50 in 2025

Navigating Retirement Savings: A Guide to 401(k) Contribution Limits for Individuals Over 50 in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Retirement Savings: A Guide to 401(k) Contribution Limits for Individuals Over 50 in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Retirement Savings: A Guide to 401(k) Contribution Limits for Individuals Over 50 in 2025

Retirement planning is a crucial aspect of financial security. Individuals over 50, often in the prime of their earning years, have a unique opportunity to maximize their retirement savings through strategies like 401(k) contributions. Understanding the specific contribution limits for individuals over 50 is essential for making informed decisions about their financial future.

Understanding the 401(k) Catch-Up Contribution

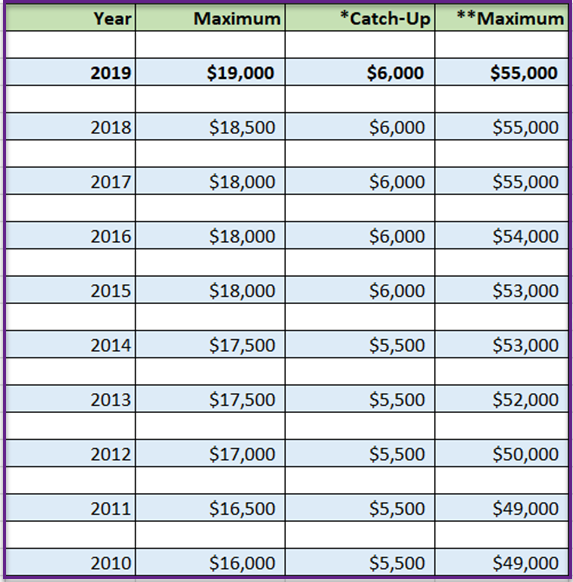

The Internal Revenue Service (IRS) allows individuals aged 50 and over to contribute an additional amount to their 401(k) plans beyond the standard contribution limit. This "catch-up" contribution is designed to help older workers accelerate their retirement savings and bridge any potential gaps in their retirement nest egg.

2025 Projections: A Glimpse into the Future

While the exact contribution limits for 2025 are not yet finalized, projections based on historical trends and current economic conditions offer valuable insights. It’s important to note that these are estimates, and the IRS may adjust these limits based on inflation and other factors.

Projected 2025 401(k) Contribution Limits:

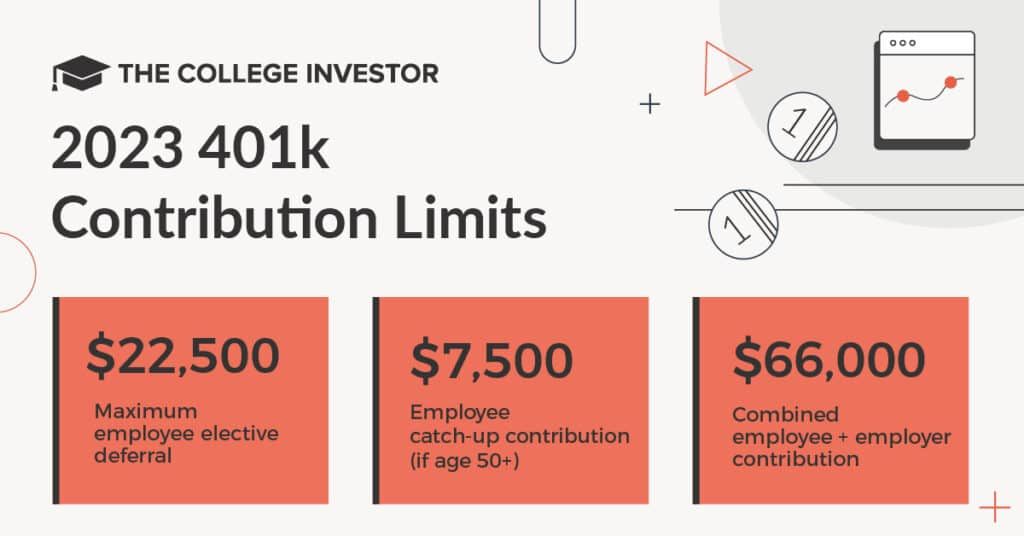

- Standard Contribution Limit: The projected standard contribution limit for 2025 is $22,500. This applies to all individuals regardless of age.

- Catch-Up Contribution Limit: The projected catch-up contribution limit for 2025 is $7,500. This additional amount is available only for individuals aged 50 and over.

Total Contribution Limit for Individuals Over 50 in 2025:

Combining the standard contribution limit and the catch-up contribution limit, individuals over 50 could potentially contribute a total of $30,000 to their 401(k) plans in 2025. This represents a significant opportunity to bolster retirement savings and potentially achieve financial independence.

The Importance of Maximizing Catch-Up Contributions

Individuals over 50 often have a higher income potential and more time to benefit from the power of compounding. Maximizing catch-up contributions can significantly impact their retirement savings. Here’s why:

- Accelerated Growth: Contributing the maximum amount allows individuals to take advantage of the benefits of compounding returns for a longer period.

- Bridging the Gap: Catch-up contributions can help address any potential shortfall in retirement savings due to delayed saving or unexpected life events.

- Tax Advantages: 401(k) contributions are made with pre-tax dollars, reducing taxable income in the present and potentially lowering tax liability in retirement.

FAQs Regarding 401(k) Contribution Limits for Individuals Over 50

Q: How does the catch-up contribution work in practice?

A: Once you turn 50, you can contribute an additional amount to your 401(k) plan on top of the standard contribution limit. For example, in 2025, you could contribute up to $22,500 as the standard limit and another $7,500 as the catch-up contribution, totaling $30,000.

Q: Can I contribute the catch-up amount even if I haven’t reached the standard contribution limit?

A: No, you must first reach the standard contribution limit before you can contribute the catch-up amount.

Q: What happens if I contribute more than the allowed limits?

A: Contributing more than the allowed limits will result in excess contributions, which may be subject to penalties and taxes. It’s crucial to stay within the established limits.

Q: Are there any specific rules for Roth 401(k) plans?

A: Yes, Roth 401(k) plans also have catch-up contribution limits. However, unlike traditional 401(k) plans, Roth 401(k) contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

Q: What if I have multiple 401(k) plans?

A: You can contribute to multiple 401(k) plans, but you must stay within the overall contribution limit. For example, if you have two 401(k) plans, you can’t exceed the $30,000 limit for the year.

Tips for Maximizing Your 401(k) Contributions

- Review Your Plan Documents: Understand the specific rules and limits of your individual 401(k) plan.

- Automate Your Contributions: Set up automatic contributions to ensure you consistently reach your desired savings goal.

- Increase Contributions Gradually: If you can’t afford to contribute the maximum amount immediately, consider increasing your contributions gradually over time.

- Seek Professional Advice: Consult a financial advisor for personalized guidance on retirement planning and 401(k) contribution strategies.

Conclusion

Understanding the 401(k) contribution limits for individuals over 50 is crucial for maximizing retirement savings. The catch-up contribution provides a valuable opportunity to accelerate savings and bridge any potential gaps in retirement planning. By staying informed about the latest contribution limits and utilizing effective strategies, individuals over 50 can lay a strong foundation for a comfortable and secure retirement.

Closure

Thus, we hope this article has provided valuable insights into Navigating Retirement Savings: A Guide to 401(k) Contribution Limits for Individuals Over 50 in 2025. We appreciate your attention to our article. See you in our next article!