A Journey Through Time: Understanding The Evolution Of IRS 401(k) Contribution Limits

A Journey Through Time: Understanding the Evolution of IRS 401(k) Contribution Limits

A Journey Through Time: Understanding the Evolution of IRS 401(k) Contribution Limits

Introduction

With great pleasure, we will explore the intriguing topic related to A Journey Through Time: Understanding the Evolution of IRS 401(k) Contribution Limits. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A Journey Through Time: Understanding the Evolution of IRS 401(k) Contribution Limits

The 401(k) plan, a cornerstone of retirement savings in the United States, has undergone significant transformations since its inception in 1978. One critical aspect of this evolution has been the adjustment of contribution limits, reflecting changing economic realities, policy decisions, and evolving retirement needs. This article delves into the history of IRS 401(k) contribution limits, examining key changes and their impact on individuals and the retirement landscape.

Early Years: A Foundation for Retirement Savings

The initial 401(k) legislation allowed for employee contributions of up to 6% of their compensation, with a maximum annual contribution limit of $7,500. These limits were modest, but they established a foundation for tax-advantaged retirement savings. The early years also saw the introduction of employer matching contributions, further incentivizing participation and fostering a sense of shared responsibility for retirement security.

The 1980s: A Period of Growth and Expansion

The 1980s witnessed a surge in 401(k) plan popularity, driven by factors such as rising healthcare costs, a decline in defined-benefit pension plans, and an increasing awareness of the importance of personal retirement savings. This period saw the contribution limits steadily increase, reflecting the growing need for larger retirement nest eggs. The maximum contribution limit rose to $11,000 by the end of the decade.

The 1990s: A Focus on Retirement Security

The 1990s brought about a renewed focus on retirement security, with the government enacting several measures aimed at strengthening 401(k) plans and encouraging wider participation. The contribution limits continued their upward trajectory, reaching $10,500 in 1997 and $11,000 in 1998. This period also saw the introduction of catch-up contributions for individuals aged 50 and older, recognizing the need for additional savings as retirement neared.

The 2000s: Navigating Economic Volatility

The 2000s brought a period of economic volatility, marked by the dot-com bubble burst and the 2008 financial crisis. Despite these challenges, the contribution limits continued to rise, reflecting the ongoing need for robust retirement savings. The limit reached $15,500 in 2008, a significant increase from the previous decade. This period also saw the introduction of Roth 401(k) options, offering individuals the flexibility to withdraw contributions tax-free in retirement.

The 2010s: Adapting to Changing Needs

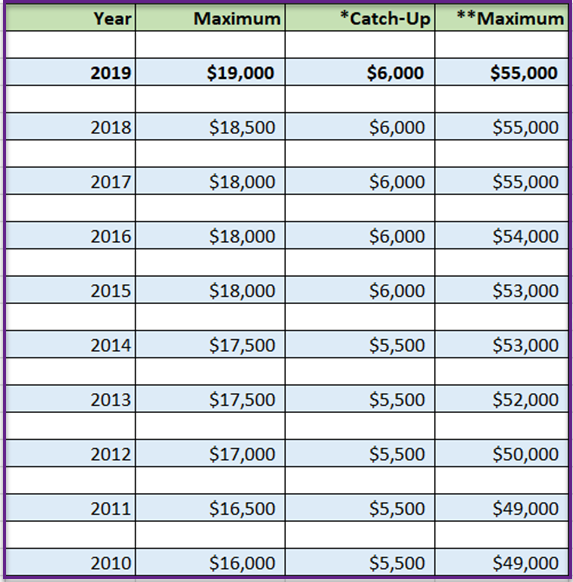

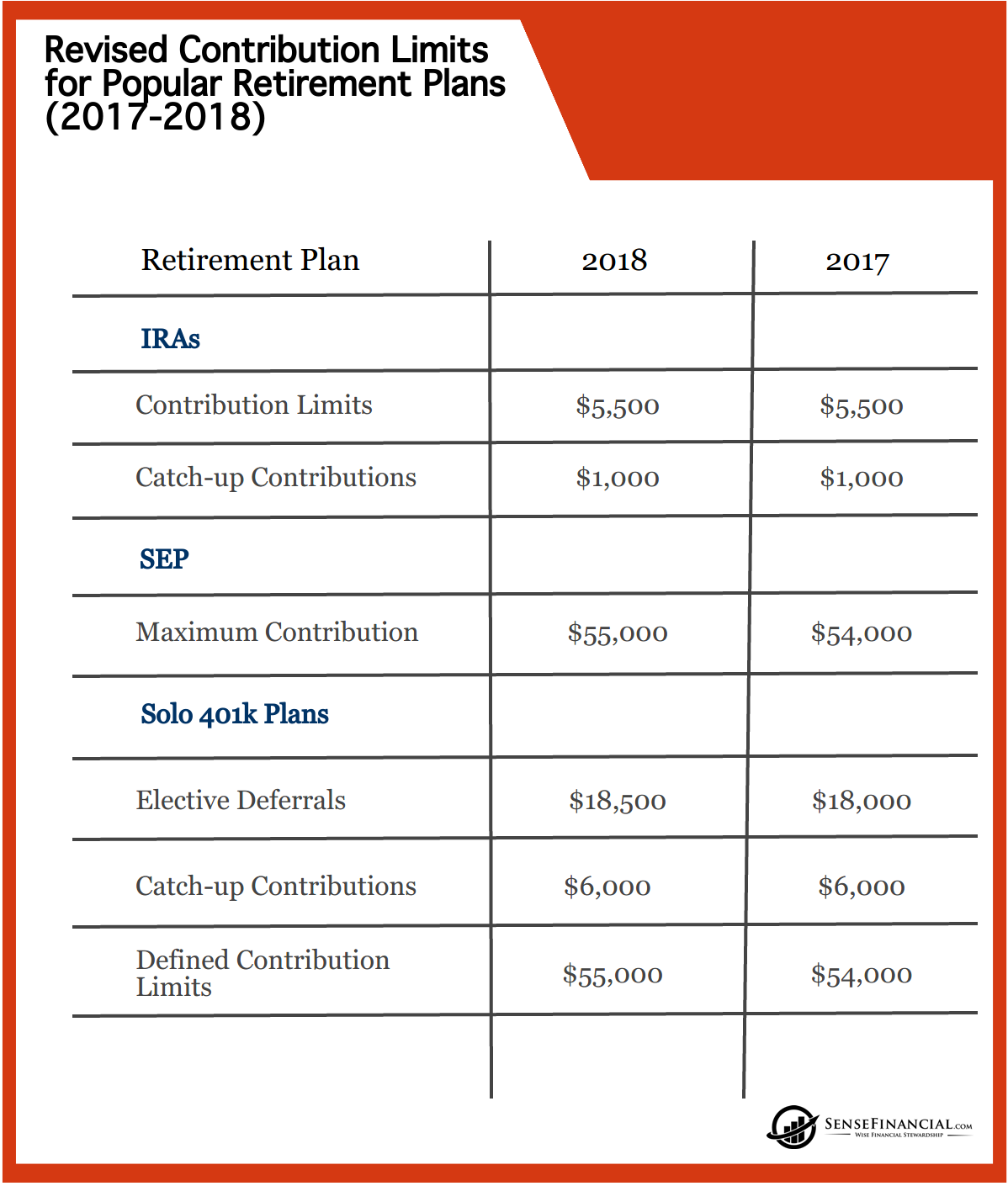

The 2010s witnessed a renewed emphasis on individual responsibility for retirement planning. The contribution limits continued their steady climb, reaching $18,000 in 2016 and $18,500 in 2017. This period also saw adjustments to the catch-up contribution limits, reflecting the growing need for older individuals to supplement their retirement savings. The introduction of automatic enrollment in 401(k) plans further encouraged participation and facilitated a more systematic approach to retirement planning.

The 2020s: A Focus on Flexibility and Access

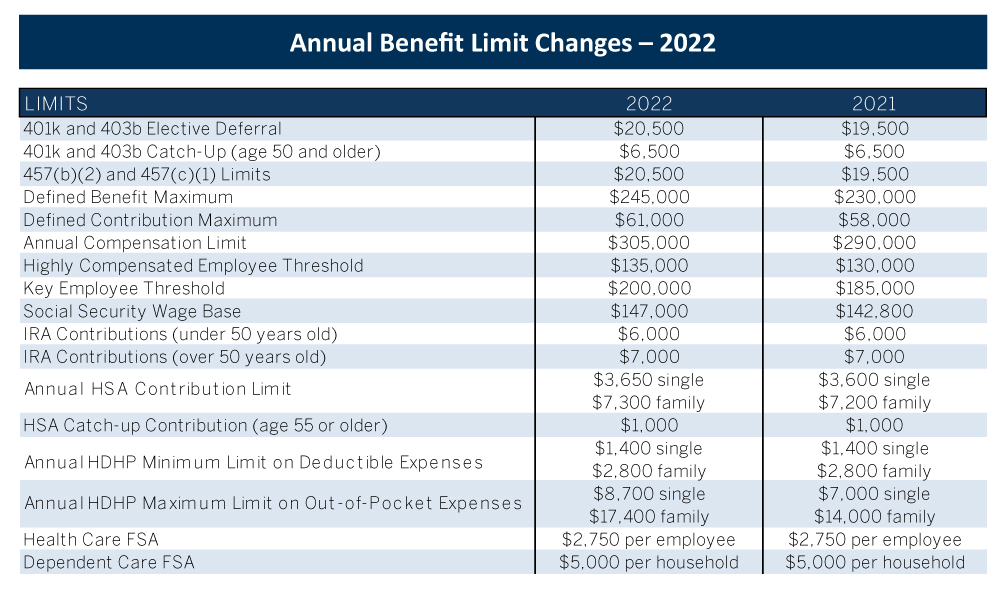

The 2020s have brought a renewed focus on flexibility and access to retirement savings. The contribution limits have continued to rise, reaching $22,500 in 2023. This period has also seen an increase in the use of financial technology (fintech) solutions, providing individuals with greater control over their retirement savings and facilitating access to financial advice. The ongoing trend towards personalized retirement planning and individual responsibility is likely to continue shaping the future of 401(k) plans and their contribution limits.

Key Changes and Their Significance

The history of IRS 401(k) contribution limits highlights several key changes and their impact on retirement planning:

- Increased Contribution Limits: The steady increase in contribution limits reflects the growing need for individuals to save more for retirement, keeping pace with rising healthcare costs, longer life expectancies, and the decline of traditional pensions.

- Catch-Up Contributions: The introduction of catch-up contributions for older individuals has addressed the need for additional savings as retirement nears, recognizing the challenges of saving enough over a shorter time horizon.

- Roth 401(k) Options: The availability of Roth 401(k) plans has provided individuals with greater flexibility in retirement planning, allowing them to withdraw contributions tax-free.

- Automatic Enrollment: The adoption of automatic enrollment has significantly increased participation in 401(k) plans, making retirement saving a default option and encouraging a more systematic approach to saving.

FAQs

Q: Why do contribution limits change over time?

A: Contribution limits are adjusted periodically to reflect changes in inflation, economic conditions, and retirement needs. The IRS uses a combination of economic data and actuarial analysis to determine appropriate limit adjustments.

Q: How do contribution limits affect my retirement savings?

A: Higher contribution limits allow individuals to save more for retirement, potentially leading to a larger nest egg and greater financial security in retirement. However, it’s essential to understand that contribution limits are just one factor influencing retirement savings outcomes. Other factors, such as investment performance and spending patterns, also play a significant role.

Q: What are some tips for maximizing my 401(k) contributions?

A:

- Contribute the Maximum: Aim to contribute the maximum amount allowed each year, taking advantage of the tax-advantaged nature of 401(k) plans.

- Consider Catch-Up Contributions: If you are 50 or older, take advantage of the higher catch-up contribution limits to boost your retirement savings.

- Maximize Employer Matching: If your employer offers a matching contribution, ensure you contribute enough to receive the full match.

- Diversify Your Investments: Spread your investments across different asset classes to reduce risk and potentially enhance returns.

- Review Your Portfolio Regularly: Periodically review your investment choices to ensure they align with your risk tolerance and retirement goals.

Conclusion

The history of IRS 401(k) contribution limits underscores the evolving nature of retirement planning in the United States. The steady increase in contribution limits reflects the growing importance of personal retirement savings and the need for individuals to take an active role in securing their financial future. By understanding the historical context of contribution limits and their impact on retirement planning, individuals can make informed decisions about their own retirement savings strategies, maximizing their contributions and working towards a secure and fulfilling retirement.

![2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide]](https://www.griffinbenefits.com/hs-fs/hubfs/2021_Retirement_401k_IRS_Contribution_Limits.jpg?width=1267u0026name=2021_Retirement_401k_IRS_Contribution_Limits.jpg)

Closure

Thus, we hope this article has provided valuable insights into A Journey Through Time: Understanding the Evolution of IRS 401(k) Contribution Limits. We appreciate your attention to our article. See you in our next article!